Dianchi Daily Insights

Stay updated with the latest news and trends in technology and lifestyle.

Breaking Down Barriers: The Good, Bad, and Ugly of Crypto Regulations

Explore the highs and lows of crypto regulations! Discover the truth behind barriers, challenges, and opportunities in the crypto world.

Understanding Crypto Regulations: What You Need to Know

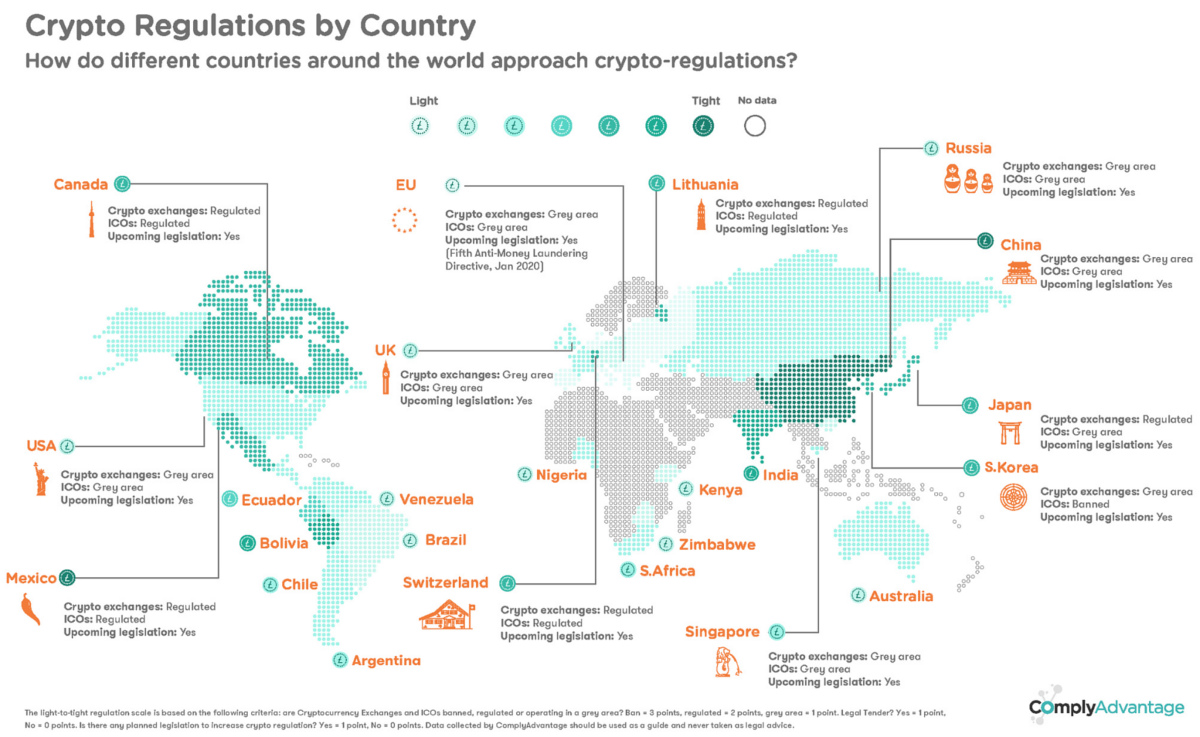

As the world of cryptocurrency continues to grow and evolve, understanding crypto regulations has become a crucial aspect for investors, traders, and businesses alike. Governments and regulatory bodies across the globe are striving to implement rules that address the unique challenges posed by digital currencies. This includes ensuring consumer protection, preventing fraud, and combating money laundering. Each country has its own approach to regulation, which can range from outright bans to a more permissive stance. Therefore, it is essential for anyone involved in crypto to stay informed about the evolving regulatory landscape.

In many jurisdictions, crypto regulations are characterized by a patchwork of laws that can vary significantly between regions. For instance, while some countries consider cryptocurrencies as assets subject to capital gains tax, others classify them as currencies and impose different tax obligations. Additionally, businesses operating in the crypto space may face specific licensing requirements, depending on the services they offer. To successfully navigate this complex environment, individuals and organizations should prioritize compliance and seek professional advice when necessary. Staying updated through reliable sources will ultimately help mitigate risks and capitalize on opportunities in the crypto market.

Counter-Strike is a popular first-person shooter video game series that emphasizes teamwork and strategy. Players can engage in various game modes, including bomb defusal and hostage rescue. For those looking to enhance their gaming experience, there are various promotions and bonuses available, such as the betpanda promo code that can provide exciting benefits.

The Impact of Cryptocurrency Regulations on Innovation: A Double-Edged Sword

The rise of cryptocurrency has sparked a wave of innovation across various sectors, from finance to supply chain management. However, the implementation of cryptocurrency regulations poses a complex challenge. On one hand, regulations can create a safer environment for investors, ensuring that bad actors are minimized and that the public's trust in digital currencies is bolstered. This can lead to greater adoption, as more businesses and individuals feel secure in engaging with blockchain technology. On the other hand, overly stringent regulations have the potential to stifle creativity and hinder the development of groundbreaking projects. Startups may struggle to navigate the convoluted regulatory landscape, diverting valuable resources away from innovation to compliance efforts.

Furthermore, the dichotomy of regulation highlights a critical tension in the ongoing development of the cryptocurrency market. Companies operating in this space must balance the need for compliance with the desire to innovate. A regulated environment could foster collaboration between traditional financial institutions and startups, leading to new financial products and services. However, if regulations are too prohibitive, entrepreneurs may be discouraged from pursuing ambitious ideas, possibly pushing innovation to more lenient jurisdictions. Thus, the impact of cryptocurrency regulations on innovation is indeed a double-edged sword, where the intent to protect can also lead to unintended consequences limiting progress.

Are Crypto Regulations a Necessity or a Hindrance? Exploring the Arguments

The debate surrounding crypto regulations has intensified as digital currencies gain popularity and mainstream acceptance. Proponents argue that regulations are a necessity to protect consumers from fraud, ensure transparency, and foster mainstream adoption. By instituting clear guidelines, regulatory bodies can create a safer environment for investors and encourage legitimate businesses to thrive in the crypto space. Additionally, a well-defined regulatory framework could enable financial institutions to engage with cryptocurrencies, thus paving the way for integration into the broader financial system.

On the other hand, critics contend that excessive crypto regulations may hinder innovation and stifle the growth of the cryptocurrency market. They argue that overly stringent rules could push startups to relocate to more favorable jurisdictions, ultimately limiting both economic opportunities and technological advancements. Furthermore, some in the crypto community believe that decentralized finance should remain free from regulation, allowing for greater creativity and autonomy. Striking the right balance between protection and freedom is crucial, as the discussion continues to evolve in this dynamic and rapidly changing landscape.